Table of Contents

ToggleCan You Pay Off Your Mortgage Faster?

Yes You Can!!

How To Bring Our Debt Level Down To a Minimum

The following suggestions are 11 ways to pay off your mortgage faster. How can you pay off mortgage faster and still enjoy life? Is this even possible? Yes it is. It is all a matter of how we allocate our earnings and what we prioritize as valuable. What is considered a “must have” to one person has no merit to another. Therefore our interests, lifestyles, enjoyments all factor in how we budget and what we prioritize as the most valuable assets in our lives.

How Much Money Should I Put Down For Purchasing A Property?

Enough So That Uncle Sam Does Not Come Knocking On Your Door

In order to stay afloat in this decade and the future manage our debt(s). Why? Because Uncle Sam already showed up at the American Super Bowl in 2025 telling us that he is coming.

Samuel L. Jackson dressed in “Uncle Sam’s” outfit came with a message for all of the people sitting in debt thinking they are rich. We have No Time To Kill. While people enjoy watching sports, gossiping, conspiring theories about people they are secretly jealous of, the richest people are warning them what is getting set up for everyone. As long as we keep borrowing tons of money adding more debt to the economy, Uncle Sam is coming for “YOU”. He called on you during the Super Bowl listening to Kendrick Lamar singing “they not like us, they not like us, they not like us…”

Who Is Uncle Sam?

The Uncle You Wished You Never Had

Googl(i)e Eye Says: Uncle Sam is the personification of the U.S. government or the United States as a whole, symbolized by an older gentleman in a top hat and patriotic attire. He is most famous for his “I Want YOU” recruitment poster from World War I, a product of artist James Montgomery Flagg. The popular origin story links the name to Samuel Wilson, a meatpacker during the War of 1812, whose barrels were stamped “U.S.” for “United States,” but became associated with his nickname “Uncle Sam“.

What are the odds? There was a man named Samuel Wilson from 1812 who Uncle Sam is named after. Today we have the modern day Samuel L. Jackson in 2025, dressed as Uncle Sam, with the same name Sam, sending us the SAM(e) message. Uncle Sam I am maybe like green eggs and ham. The same name(d) Sam..a.k.a. Uncle Sam from 1812 was a meatpacker, after all.

In 1994 Samuel L. Jackson starred in the movie, A Time To Kill.

Kill….Meat….get it?

Both Samuel Wilson and Samuel L. Jackson have the names SAM and SON in their names.

Jesus Christ is the son of man. Samson is in the bible. The band Genesis (Genesis is the first book of the bible), sings a song called, No son of mine.

“You’re No Son, you’re no son of mine”, while the sons of man keep sinning.

What Is The Book Of Genesis?

Google Says:

The book of Genesis is the first book of the Bible, detailing the creation of the world and the early history of humanity. It is divided into two main parts: the first 11 chapters cover the “primeval history” (creation, Adam and Eve, Noah, the Tower of Babel), and the rest of the book (chapters 12–50) focuses on the “patriarchal history” of the Israelites, beginning with God’s covenant with Abraham and continuing through his descendants Isaac, Jacob, and Joseph.

Who Is Samson In The Bible?

A snippet from Gotquestions.org.life-samson

The life of Samson – God is merciful

The Philistines thought they would celebrate their great victory over Samson, and the rulers assembled in the temple of their god, Dagon, to praise him for delivering Samson into their power (Judges 16:23). During the festivities, they brought Samson from prison to entertain them. Leaning against the support pillars of the pagan temple, “Samson prayed to the LORD, ‘O Sovereign LORD, remember me. O God, please strengthen me just once more, and let me with one blow get revenge on the Philistines for my two eyes’” (verse 28). God mercifully granted Samson’s request. Samson “pushed with all his might, and down came the temple on the rulers and all the people in it” (verse 30). Samson killed more when he died—about 3,000 Philistines—than while he lived.

Samson was a man of faith—he is mentioned in the Bible’s “Hall of Faith” (Hebrews 11:32). At the same time, he was a man of the flesh, and his many mistakes serve as a warning to those who would play with fire and expect not to get burned. The life of Samson shows us the importance of relying on God’s strength, not our own power; following God’s will, not our own stubbornness; and seeking the Lord’s wisdom, not our own understanding.

DISCLAIMER:

I am not an accountant am not certified in the financial field. However, I am a neighbour, an average Joe with a mortgage and know a couple of things. Use your discernment and reach out to a financial advisor if this is not enough. Take what resonates and leave out the rest. Thank you for reading forward.

How Can You Pay Your Mortgage Off Faster?

Make Practical Decisions And Be Safe Instead Of Sorry

1. Rent Before You Buy

These suggestions are for anyone with a mortgage or thinking of buying one. If you have a growing family consider renting for at least 5 years before buying. This is so that you build a minimum down payment of 20% or more for your first property. Now there is a solid amount of money invested your home. Putting down 5-20% for a property is a sign that you are biting off more than you can chew. Make a minimum down payment of at least 20% to actually own a portion of something solid.

Stress free mortgages are the best option for any homebuyer which is something most people cannot do, myself included. So try putting a big down payment instead. Renting a small space for a short period of time will help build your savings and prepare you for the next big step, having a mortgage.

2. Use Your Common Sense/Cents

When we have a mortgage it means that we bought a loan. Depending on the interest rate and how much we borrow, how long that loan remains unpaid, this purchase can be very expensive. A mortgage holder can easily pay enough interest to put down for another property for the duration they held that loan.

Use your money wisely and stretch your earnings. If the purchase of your loan ends up costing the same as a large down payment for another property, you are buying a very expensive loan. This means if your loan ends up costing you $200,000 in interest for the duration you held that mortgage, that is a waste of money.

This amount in paid interest is enough for a 20% down payment for a million dollar property. It is also a 40% down for a 500k property. Why would you waste $200,000 dollars paying off interest to pay off your current property when that can money be used for something nicer, bigger perhaps? It is not a good idea to pay a lot of your hard earned money on interest.

Most people do not want to know how much they are actually paying for that loan. If they knew many would change their ways. You cannot look at a mortgage as free money because it is not. Be careful how much you buy from a bank. If people knew how much I paid for in interest for my first property they would not believe me. Mind you I lived in a condo for 8 years prior to buying it. This helped me put down more than 20% and save a lot of money.

3. Buy Small, Live Large

Depending on your lifestyle, if you do no like house chores and travel a lot for example, buy small and live large. This is a great way to pay off your mortgage faster. Those living in a small condo adapt quickly on how to live well in a little space. Earn a lot of money during this time. Work full-time and if you do not have a 9-5pm job, be a hustler in your field. These kinds of home owners who buy small and live large have the ability to achieve a good life with lower mortgage costs.

There are opportunities to travel, vacation, enjoy nights out in the city, go shopping and be able to pay for it. You can spend a little money on activities that cost extra as well. The funny thing is that to the outside world and the people around you, you will look like the poorest ones from the bunch. Yet, you will be the least stressed, can go out and have fun because of it. Plus, this will get better as you build small and live large.

Trying To Look Rich

Most people jump into buying a large property right away. It is an ego thing. They want to look like they have it all. However, some of these owners have tenants, roommates, extra people living in the house to help them to pay their bills for years. Is that rich or someone trying to look rich? I would rather live in a condo and it be my space, my privacy and for me to able to afford it without having tenants in my place to pay my bills. Someone living in a house they own with tenants renting a room is a sign of someone who did not put enough money down for their property.

The smaller your property, the higher likelihood of a smaller mortgage. Even though some condos are over a million dollars, we can still find condos that are in the $500K range today, as prices fluctuate. Depending on where you live the prices are even less than $500,000.

You will be able to buy a smaller mortgage loan purchasing a condo instead of going for a larger property. So if you have not gone this route, do it to save and build and learn to organize your space like a zen master. Your life will level up within 5 years.

4. Focus On Making Big Payments And Find Creative Ways To Spend Your Time

It is likely that you live with other people, whether it be a partner, children, roommates, etc. Each person in that house is talented in something. Someone might be a good singer, flute player, piano player, actor, comedian, math wiz, artist, researcher, debater, cook, baker, the list is endless. Entertainment is already in the home and can be shared freely while the loan holders (parents), pay off the mortgage in the background of daily life.

Expressing our creative abilities without spending money is priceless. It brings good memories in the home, creative acts of expression, a greater sense of unity, light heartedness and joy. We do not need to spend money to be entertained as there are a lot of free things to do that will keep us busy.

Make some delicious healthy foods with your friends, family and enjoy. Having a good time does not cost much. Go out on a date by the lake and have a picnic out in nature while saving money.

Play tennis at a tennis court, basketball and other sports for free. Getting together for potlucks with other family and friends, sharing songs, jokes and laughs are more ways to build our wealth while saving our money. If we are not around people, read a book, meditate, cook, sing, write, garden, do yoga, watch or listen to something, go to the temple, volunteer and meet others. There is so much to do for free.

5. Increase Your Payments

According to experts the rule of thumb that is given to most homebuyers is to pay only 30% of your monthly income. If you are paying off more than 30% of your monthly income they call these people, “cost burdened”. The truth is you are not cost burdened, you are smarter than the rest. Why would a bank tell you that 30% is too much when your low payments is what makes them money? Increase making payments on your mortgage to benefit you.

Benefits For Paying Off Your Mortgage Faster

For one you save paying interest on that loan amount because you put it towards your principle. Two, you just lowered your overall mortgage amount. Three, the money went to something that is an asset and not a liability, interest. Interest is a liability because it costs more energy just to pay that off. As long as you live in your house and see yourself as an asset, your house is an asset. The higher your monthly payments are the better it is for your future.

Four, the faster you pay it off, the more time and money you save in the end. This means freedom comes sooner. Increase your monthly payments today to be stress free tomorrow.

Do not put a cap on how much money you can save in a month. If you can save 75% of that paycheque towards your mortgage, save it. Continue making regular monthly payments and put the remainder of the cheque to the side. Once you can save enough money to make double payments do it. It works out all the better for you.

6. Take Advantage Of Making A Large 15% Payment Towards Principle

By taking advantage of the 15% yearly payments towards the principle you are tackling your mortgage payments quickly. Build up some savings for 12 months and at the end of the year make one lump sum payment towards your principle. That is a huge chunk of stress off your back.

The amount of interest saved can range anywhere between $5000.00-$25,000.00 a year, depending on your mortgage amount and what the maximum 15% of your mortgage is. Those who would rather spend $300.00 for dinner every other week instead of paying off debts is one reason why people cannot pay off their mortgage faster. Your $300.00 dinners are coming in a moment. Get your priorities in order first and reap the rewards after. It takes time so be patient and consistent.

7. Take The Smallest Mortgage Amount Possible

Just because the bank said you are eligible for $500k mortgage, it does not mean to go ahead and max it out to that amount. After all, we owe this money back, with interest. Banks love to play with numbers, therefore you should too. Play around with your maximum limit of payments, how high of an interest rate you are willing to go, what term of the mortgage you are willing to accept and how long you want the amortization to be. Sit in the drivers seat with your money. This is your loan and you have to pay off your loan all alone.

“How Do I Get You A Loan? A Loan? A Loan?”

Get a Mortgage/Morgue Age

This is business and the banks have no Heart (a ROCK band), but will sell you a loan to pay off alone without a song and tune.

One day banks will come out with commercials from the band Heart. The mortgage agent will sing, “How do I get you a LOAN? A Loan? A loan?” “You don’t know how long I’ve been waiting, to take your money and hold it tight”. Song by HEART.

If any bank uses this song as a mortgage commercial please pay me 50% in profits for giving you a really good suggestion to get your clients a loan, alone. I will use that money to put a down payment for A Loan at your bank. Ka Ching!!! 😉

When you are able to pay off a small mortgage, which in today’s world is huge compared to 30 years ago, you accomplish real financial freedom. Not owing anything to anyone can make you think of your next step in life. Taking on a small mortgage in increments will help you in the long run because you can pay the loan off faster.

How Much Borrowing Is Too Much Money?

8. Set Concrete Goals To Pay Off Your Mortgage ASAP

Anything over 300k that you are borrowing for 10 years or more is too much money for that long of a duration. If this 300k can get paid off within 5 years, then it is easier to tackle and better to take on. Also, if you are in your 20’s with a good paying full-time steady job and this is your case, yes, take that loan.

Imagine having a condo paid off by or before 30 years old, that is sweet! Have a goal, for example, that what you borrow will be paid off in less than 10 years. Once that goal is accomplished, you can move on to the next adventure. Now you do not have to stress paying off a loan that left you unable to be a real creator of some kind.

Life gets a little more calm now and you can breathe better. It does not matter if you have a paid off small apartment that is paid off. That is an excellent job!!! This is huge progress and you have built yourself a solid foundation.

Play With Your Money And Have Fun

For example, say you bought a condo in a small town for 300K. You put down 20% which is 60k. That leaves you with a 240k loan remaining. This is what you just bought from the bank, a $240,000 loan. At an interest rate of 5% the monthly payments are $4529.00 a month for 60 months straight. Yes, that is a lot of money, but if you earn this much in a month and more it is possible to achieve. A person earning an average of $100,000 a year can achieve this goal. If you make a goal to pay this property off within 5 years and achieve it, you just saved a lot of money, time, stress, mental health, aging at a rapid speed and more. Your life after these 5 years will become really sweet.

Calculating How Much You Pay In Interest For What You Borrow

The total amount of interest you will have paid for the duration of this loan is $31,407. This means the total amount of that property is actually $331,407.00, not including maintenance and property taxes. However, if this loan was extended to 10 years, the total loan amount would be $64,747. That is more than double the amount of interest. Now you paid $364,747 for that condo. You could have bought a brand new car with that extra money you paid in interest by adding an extra 5 years to paying off your mortgage with an added $33,340.00.

Time Is Money

Imagine paying off your property within 5 years and in the 6th year buying a paid off brand new car. That is possible. Not saying this is what I want because I have been driving the same car since 2012, share it and I like it. New cars with their gadgets are an absolute nightmare. If I buy a new car I hope it is simple and one that is not co-dependent on a shady mechanic to tell me that I have to leave my car with them overnight. Then spend 5 hours fixing the problem and charging me a few thousand for a new button sensor.

You never know. I may walk into a car dealership and next thing you know, out with what I said I will not get and end up with it. *sigh*. That is why it is best to pay off your mortgage faster. Get it out of the way before making other possible hasty decisions.

The Other Option

Instead you decide to take the million dollar condo, put 200k down and pay for a 800mtg. For a 2 bed 2 bath condo in the heart of the city at an 800k mortgage, expect to be in at least 20 years of mortgage debt stress. At an interest rate of 5% for 20 years the monthly payments are $5279.00. This is more than the $4529 payment with a $260k mtg. at 1/4 the time to pay off.

When you borrow less you stress less and get concrete financial goals achieved. Now it is not a matter of having a million dollar condo with an $800,000 loan on it. It is about owning a fully paid condo at $300,000.00 within 5 years that will elevate your economic status with a solid financial foundation even if no one can see it on the outside. Privately you can build your true financial portfolio much faster than someone with an $800k mortgage, for example.

If you have a property paid off in full and that condo/house is rented giving you passive income then an $800k mtg is possible to pay off within 10 years. With a full-time paying job of $100k after taxes, you can handle this mtg. That also depends on your lifestyle. If you like to look rich you will probably have a poor life. But if your wealth is generating wealth then you can afford it and not squirm on the inside.

Good Things Come In Small Packages

Pay your small property off in full and use it as a down payment for the next new property. The second one is likely larger, nicer, maybe a bit more private and you are enjoying a better lifestyle now. However, do not underestimate the power of small properties. They save you a lot of money in the long run to get further ahead in this rat e(race) of life.

To help you build a solid foundation, purchase my book, The Power Of One, Quietly Build A Solid Foundation While Others Continue To Gossip Behind Your Back. It is for sale on Amazon. Thank you for your support.

How Do I Build Wealth Making Less Money?

9. Cut Corners With Your Money In Other Ways

I cut corners with my money because working on my own is a lot tougher without a steady paycheque. In the beginning of my financial journey I ate non expensive healthy vegetarian foods, cooked at home. I shared a closet with my partner (which is something most women will not sacrifice), went to free summer events, festivals, community celebrations etc. I did my own beauty care, cut my own hair, did my own skin care, manicures, pedicures, etc. This costs a lot of money each year.

Work Out At Home

I practice yoga on my own without paying for expensive classes. I work out at home riding my stationary bike and walking on the treadmill. To change it up I go for free walks in and around the city and more. These are just some personal changes we can make that saves us a lot of money when we add all of these kinds of expenses up. Once we see what we are spending on and what is worth it or not, we can make better choices.

Looks Are Deceiving

Many people around us purchased properties 4 times larger than ours and are drowning in debt today. Back then I was being mocked by the same people who paid more than $200k over asking for a property to look “richer” than you but are running around like rats on a wheel and are still not happy. With a lower mortgage we are stress free, they are not. Who cares what people think about how poor you look.

They are not paying your bills. These same people will complain that you, the one with a small mortgage and less stress, has an easy life. Did you sacrifice what I sacrificed to achieve my goals? More than likely not! We are not partying with people who could not care less about us because we choose to take care of ourselves.

Show And Tell At 50 Years Old

Also, many people are too busy playing “pick meesha”, show and tell at 50 years old with other two faced wanna bees. What do you expect? If you are too obsessed with how others see you and compete with you, the goals you have for real wealth and financial freedom will be side swiped. This is why you must stick to your personal mission and hit your target no matter what others around you are doing. They are NOT paying your bills. I did not fall for “keeping up with the Joneses” hypnosis like the rest of the world did. These people are losing because no one likes them at their own wanna be “party girl” parties anyway. Meanwhile, you continue building, slowly or quickly, depending on your earnings and savings.

10. Focus On Your Priorities

Take a look at what is important to you in your life. Is it being a top notch hostess at parties, looking for a good time? Well that costs money. Dressing up and talking small talk with people who do not like you in the first place costs a lot of money.

Do not waste your life and time on people who pretend to like you but are gossiping behind your back. They are jealous, competitive, catty and low brow. Your life will be wasted on those who do not want to enjoy life with you but want to ruin you and put you down so that they can feel good about their low vibrational selves. No matter how awful superficial people are focus on your own goals, missions, dreams and visions and let them talk behind your back. The barking never stops. You are no ones loyal lap dog. Stay in your lane and win a race you were never running with them in the first place. Then you will win without them.

Treat Your Home Like A Sanctuary

Do not disrespect your space. If you live in a trailer and paid $50,000.00 for that trailer, treat your asset with respect. When you do this you are energetically inviting wealth into your life. If your trailer is cluttered with beer cans, dirty clothes, unwashed dishes, etc, you are saying you have a value of a bum. Meanwhile you are living in a $50,000.00 trailer. Pay it off and clean that place like it is a mansion. Then sell it and move to something better. Build up your wealth and focus on a solid financial goal. This is a great way to help pay your mortgage off faster.

What Is The Best Way To Help Pay Off My Mortgage?

11. Invest In Long-Term Gains And Wisdom For The Future

Leave something behind “for the children of tomorrow can dream again….in the Wind of change” instead of becoming scorned bitter spice girls who are leaving us behind with only a few good men who got badly bitten by Scorpions.

To build up your motivation, confidence and internal juices:

Buy my Books:

The Power Of One: Quietly Build A Solid Foundation While Others Continue To Gossip Behind Your Back

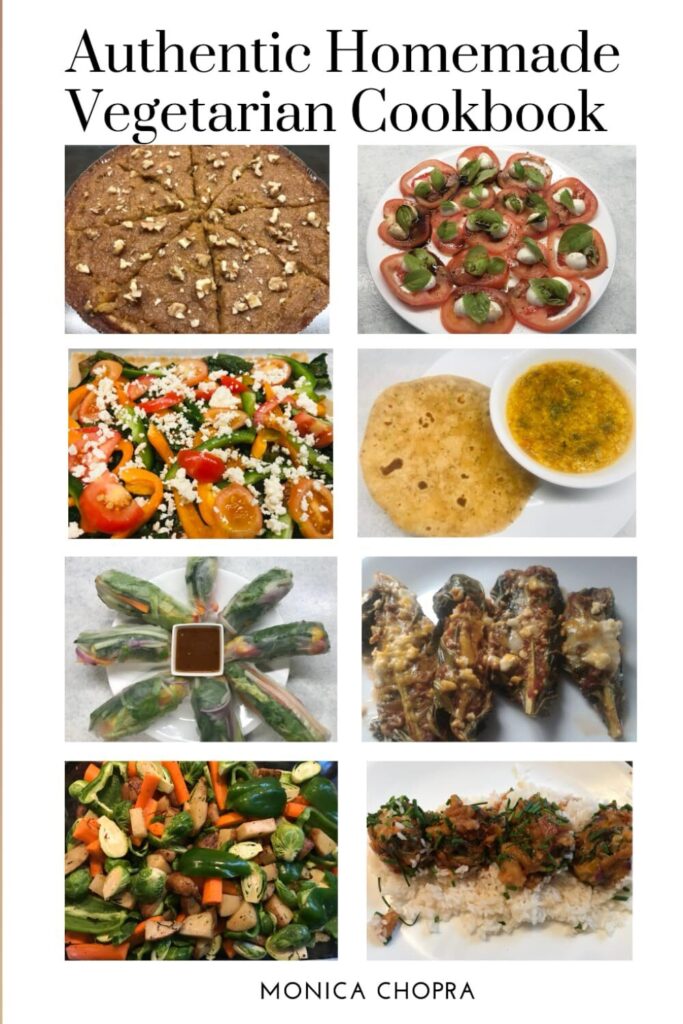

Authentic Homemade Vegetarian Cookbook

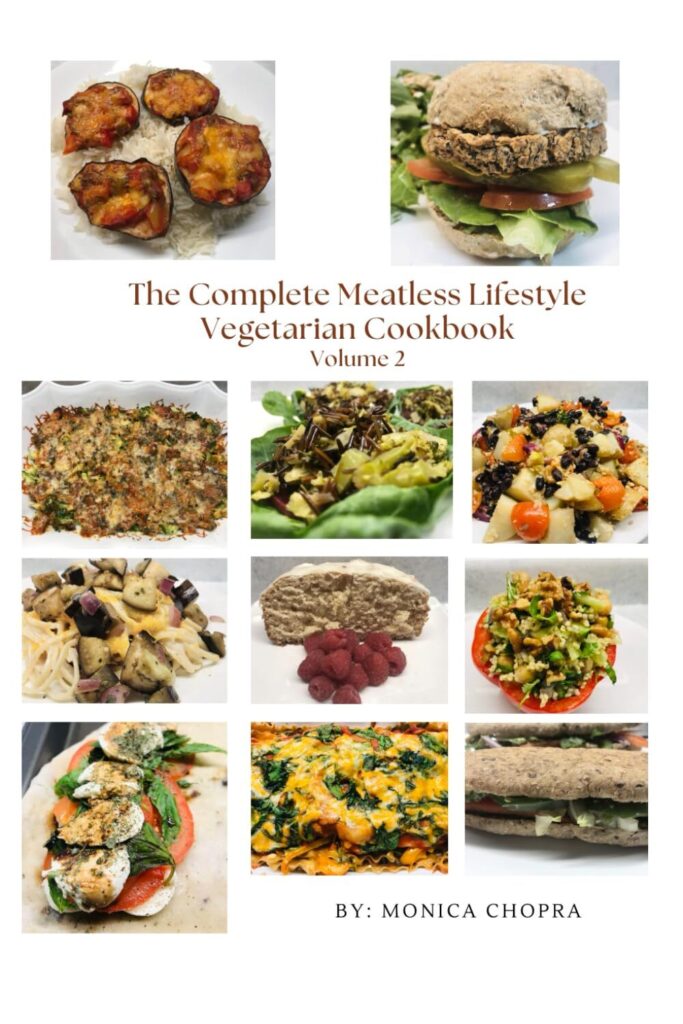

The Complete Meatless Lifestyle Vegetarian Cookbook – Volume 2

They are available for sale on Amazon. Thank you for purchasing all my books and for your support. BUY these books for you, your friends and family for CHRISTMAS!!

Then build your own solid foundation and leave something behind for the future generations to come.

May you receive 10 folds of abundance in return.

December 8, 2025